POET Technologies Reports First Quarter 2021 Financial Results

May 27th, 2021

TORONTO, Ontario, May 27, 2021 – POET Technologies Inc. (“POET” or the “Company”) (TSX Venture: PTK; OTCQX: POETF), the designer and developer of the POET Optical Interposer™ and Photonic Integrated Circuits (PICs) for the data center and tele-communication markets, today reported its unaudited condensed consolidated financial results for the first quarter ended March 31, 2021. The Company’s financial results as well as the Management Discussion and Analysis have been filed on SEDAR. All financial figures are in United States dollars (“USD”) unless otherwise indicated.

First Quarter Financial (non-IFRS) and Recent Business Highlights:

The Company continued to execute on its strategic plan during the first quarter and achieved the following significant milestones during the three months ended March 31, 2021:

- Completed the design of a 100G LR4 (4 channel Long Reach) optical engine with a reach of 10km (kilometers) for client-side interconnects to data centers, enterprises and edge computing networks;

- Made significant progress with joint-venture company, Super Photonics Xiamen (“SPX”), including the appointment of the board of directors and key personnel, completion of 5,000 square feet of operating facilities, ordering of key capital equipment for installation and qualification in April-May and receipt by SPX of approximately $5.0M from Sanan IC to cover initial operating and capital expenditures;

- Entered into development and supply agreements with a technology leader in photonic neural network systems for artificial intelligence (AI), which represents an entry point into the new large and extremely high-growth chipset market for AI applications;

- Completed a private placement of 17,647,200 units of the Company at a price of CAD$0.85 per 2021 Unit for gross proceeds of approximately CAD$15M, including the full exercise of an agents' option;

- Raised $8.5M from the exercise of stock options and warrants, and further improved liquidity by $2.3M through the conversion of convertible debentures;

- Ended period with cash and cash equivalents of $23.5M, compared to $6.9M on December 31, 2020 and $12.3M on March 31, 2020;

Management Comments

“We have continued to make solid progress on our strategic and commercialization initiatives over the past few months,” stated Dr. Suresh Venkatesan, Chairman & CEO. “Following the achievement of key technology milestones, including the successful testing of designs for multiple products, we are experiencing strong pull from customers that recognize the disruptive value proposition of POET’s unique approach to integrated solutions. We are now working closely with customers on further product customization for their specific end market applications and with others on project proposals to leverage the benefits our Optical Interposer platform for specific end market applications.

“As part of the continued build-out of our robust product development pipeline, we recently announced the completion of our design for a 100G LR4 optical engine targeted for client-side interconnects for data centers, enterprises and edge computing networks. As the industry standard for interconnects in long-haul networks, we believe 100G LR4 transceivers represent a rapid go-to-market opportunity to address a high-volume market leveraging the significant cost and performance advantages our transmit (Tx) design.

“Additionally, we continue to advance our joint venture with Super Photonics Xiamen to support the anticipated increase in customer demand and associated commercial production. SPX has begun the installation and qualification of the equipment that will provide the ability to scale and ramp volume manufacturing in 5,000 square feet of SPX’s temporary operating facilities. “

Dr. Venkatesan concluded, “With our planned participation in the upcoming OFC Conference and Exhibition in June, the POET team is working closely with a number of customers and ecosystem partners for hosting technology demonstrations and virtual meetings. We plan to provide updates on the expected near-term availability of product prototypes in conjunction with the OFC Conference.”

Financial Summary

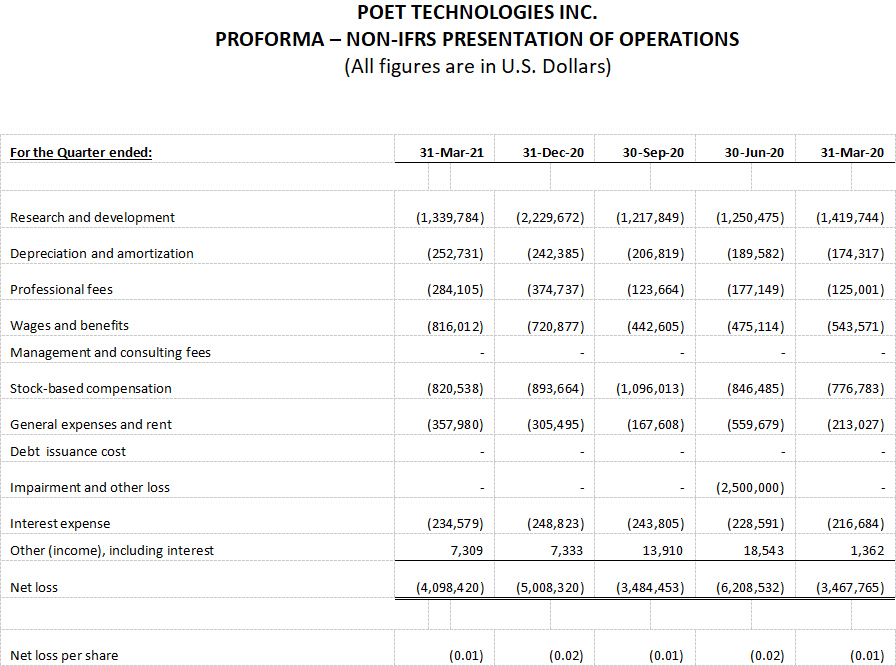

The Company reported a net loss of $4.1 million, or ($0.01) per share, in the first quarter of 2021 compared with a net loss $3.5 million, or ($0.01) per share, for the same period in 2020 and a net loss of $5.0 million, or ($0.02) per share, in the fourth quarter of 2020. The net loss in the first quarter of 2021 included research and development costs of $1.3 million compared to $1.4 million for the same period in 2020 and $2.2 million in the fourth quarter of 2020. R&D for a Company at this stage of development will vary from period to period as variable expenses with contract manufacturers fluctuate based on the development cycle and the immediate product development needs of the Company.

Non-cash expenses in the first quarter of 2021 and 2020 included stock-based compensation of $0.8 million and depreciation and amortization of $0.3 million and $0.2 million, respectively. Non-cash stock-based compensation and depreciation and amortization in the fourth quarter of 2020 were $0.9 million and $0.2 million, respectively.

The Company had debt related finance costs of $235,000 compared to $217,000 in the first quarter of 2020 and $249,000 in the fourth quarter of 2020. Of the finance costs recognized in the first quarter of 2021, $128,000 was non-cash compared to $109,000 during the same period in 2020 and $128,000 in the fourth quarter of 2020.

On a non-IFRS basis, cash flow from operating activities in the first quarter of 2021 was ($2.5) million compared to ($2.0) million in the first quarter of 2020 and ($2.9) million in the fourth quarter of 2020.

Non-IFRS Financial Performance Measures

Certain financial information presented in this press release is not prescribed by IFRS. These non-IFRS financial performance measures are included because management has used the information to analyze the business performance and financial position of POET. These non-IFRS financial measures are intended to provide additional information only and do not have any standardized meaning under IFRS and may not be comparable to similar measures presented by other companies. These non-IFRS financial measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

About POET Technologies Inc.

POET Technologies is a design and development company offering integration solutions based on the POET Optical Interposer™ a novel platform that allows the seamless integration of electronic and photonic devices into a single multi-chip module using advanced wafer-level semiconductor manufacturing techniques and packaging methods. POET’s Optical Interposer eliminates costly components and labor-intensive assembly, alignment, burn-in and testing methods employed in conventional photonics. The cost-efficient integration scheme and scalability of the POET Optical Interposer brings value to any device or system that integrates electronics and photonics, including some of the highest growth areas of computing, such as Artificial Intelligence (AI), the Internet of Things (IoT), autonomous vehicles and high-speed networking for cloud service providers and data centers. POET is headquartered in Toronto, with operations in Allentown, PA and Singapore. More information may be obtained at www.poet-technologies.com.

Shareholder Contact: |

Company Contact: |

This news release contains “forward-looking information” (within the meaning of applicable Canadian securities laws) and “forward-looking statements” (within the meaning of the U.S. Private Securities Litigation Reform Act of 1995). Such statements or information are identified with words such as “anticipate”, “believe”, “expect”, “plan”, “intend”, “potential”, “estimate”, “propose”, “project”, “outlook”, “foresee” or similar words suggesting future outcomes or statements regarding any potential outcome. Such statements include the Company’s expectations with respect to the success of the Company’s product development efforts, the performance of its products, the expected results of its operations, meeting revenue targets, and the expectation of continued success in the financing efforts, the capability, functionality, performance and cost of the Company’s technology as well as the market acceptance, inclusion and timing of the Company’s technology in current and future products.

Such forward-looking information or statements are based on a number of risks, uncertainties and assumptions which may cause actual results or other expectations to differ materially from those anticipated and which may prove to be incorrect. Assumptions have been made regarding, among other things, management’s expectations regarding the success and timing for completion of its development efforts, financing activities, future growth, recruitment of personnel, opening of offices, the form and potential of its joint venture, plans for and completion of projects by the Company’s third-party consultants, contractors and partners, availability of capital, and the necessity to incur capital and other expenditures. Actual results could differ materially due to a number of factors, including, without limitation, the failure of its products to meet performance requirements, lack of sales in its products, once released, operational risks in the completion of the Company’s anticipated projects, lack of performance of its joint venture, delays in recruitment for its newly opened operations or changes in plans with respect to the development of the Company’s anticipated projects by third-parties, risks affecting the Company’s ability to execute projects, the ability of the Company to generate sales for its products, the ability to attract key personnel, and the ability to raise additional capital. Although the Company believes that the expectations reflected in the forward-looking information or statements are reasonable, prospective investors in the Company’s securities should not place undue reliance on forward-looking statements because the Company can provide no assurance that such expectations will prove to be correct. Forward-looking information and statements contained in this news release are as of the date of this news release and the Company assumes no obligation to update or revise this forward-looking information and statements except as required by law

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

120 Eglinton Avenue, East, Suite 1107, Toronto, ON, M4P 1E2- Tel: 416-368-9411 - Fax: 416-322-5075

< Back to News